Workamping in New Mexico: Month Two Update

Disclaimer: We are in no way affiliated with or representing Jackson Hewitt. We are simply detailing our experience for those interested in our Workamping Job in Albuquerque, New Mexico.

FEBRUARY 28: We are already more than halfway done with our workamping job in New Mexico and we can’t believe it. I know we throw the word around a bunch and we have been workamping as long as we have been full time RVers. But what really is this “Workamping” thing we speak of. The term was coined by and is a registered trademark of Workamper News, which is our top source for locating these jobs. It blends the words “work” and “camping” which essentially defines what we do as we travel around the country in our RV, working at different places along the way. Not being of true retirement age, this is our main source (or really, only) source of income and allows us to continue our nomadic lifestyle. The most frequent jobs are at RV parks and campgrounds with the runner-up being working at or around a National Park. While we have done both of those, we also have had unique workamping jobs including at an Amazon warehouse as part of their Amazon Camperforce program and now as tax preparers for Jackson Hewitt. The appeal of workamping for us is three-fold: the opportunity to learn and try new things, that short-term commitments are the name of the game and that it allows us to “live” in all sorts of different parts of the country. So with that being said, what do our days as a workamper look like. We have written a “Day in the Life” during all of our workamping gigs which you will see posted below and in this post we will outline our typical work day as a Jackson Hewitt Tax Professional and believe it or not it doesn’t include dinner with Uncle Sam.

There are four Jackson Hewitt store front locations and eleven Jackson Hewitt Walmart kiosk locations within the Albuquerque market. Most are within a 10-15 minute drive of our home base which is the Albuquerque KOA. Other locations are a bit further, requiring a 30-45 minute drive which isn’t our preference, but sometimes necessary to satisfy the needs of the business. Our morning departure time is determined by our location assignment for the day, but we plan to arrive at least 15 minutes before our scheduled shift.

Upon arrival to our scheduled location, which is typically one of the storefront locations. We grab our lunch bags, water bottles and backpack looking like real office professionals as we head to unlock the office door.

We immediately jump into getting the office “customer-ready” for the day. The end of the day is typically the busiest, so sometimes chairs are a bit askew or dusty footprints are left from the last customer of the day. Once the office is looking in tip-top shape for another full day of tax prep, it is time to make sure the computers are ready as well. Let’s be honest, they are the true “brains” of the process.

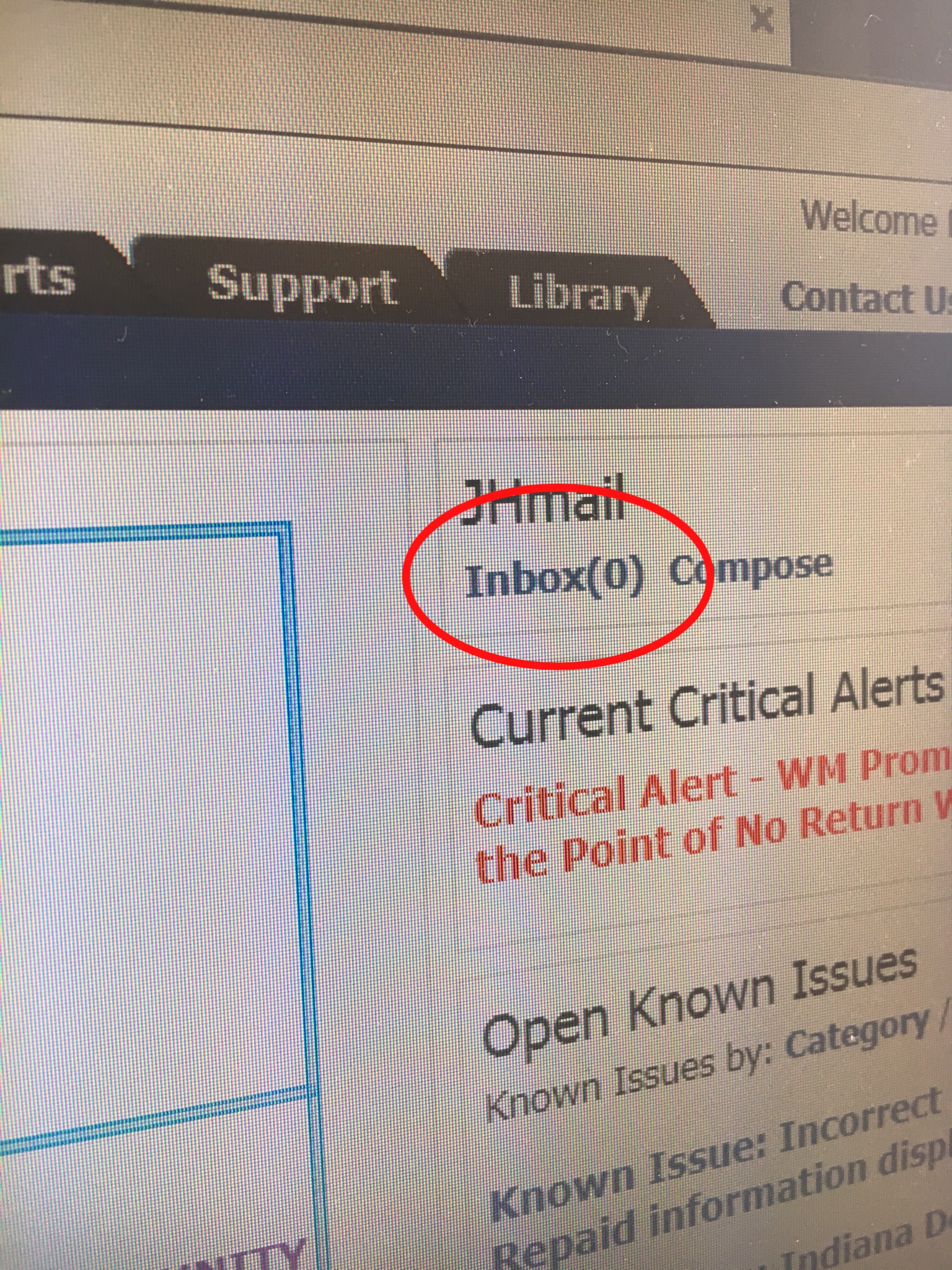

Typically, the computers and hardware run without issue, but occasionally we have to play the role of tech guru to get things processing smoothly. Once up and running, we get logged into all the systems that will help us during the day. Our “phone-a-friend” type resources like Ask JH and Slack are utilized throughout the day for both sharing information, asking questions and even greeting our co-workers in different offices. Due to using this corporate-friendly chat client, emails are rarely used for communication, but this is also a moment to check those as well.

Next up, a quick glance at the appointment calendar to get our bearings for the day. Some weeks it looked like the first photo (busy, busy) and others it looks the latter photo (not so much). The slight blur in the photos is on purpose — remember, we are true tax pros — protecting client information is utmost!

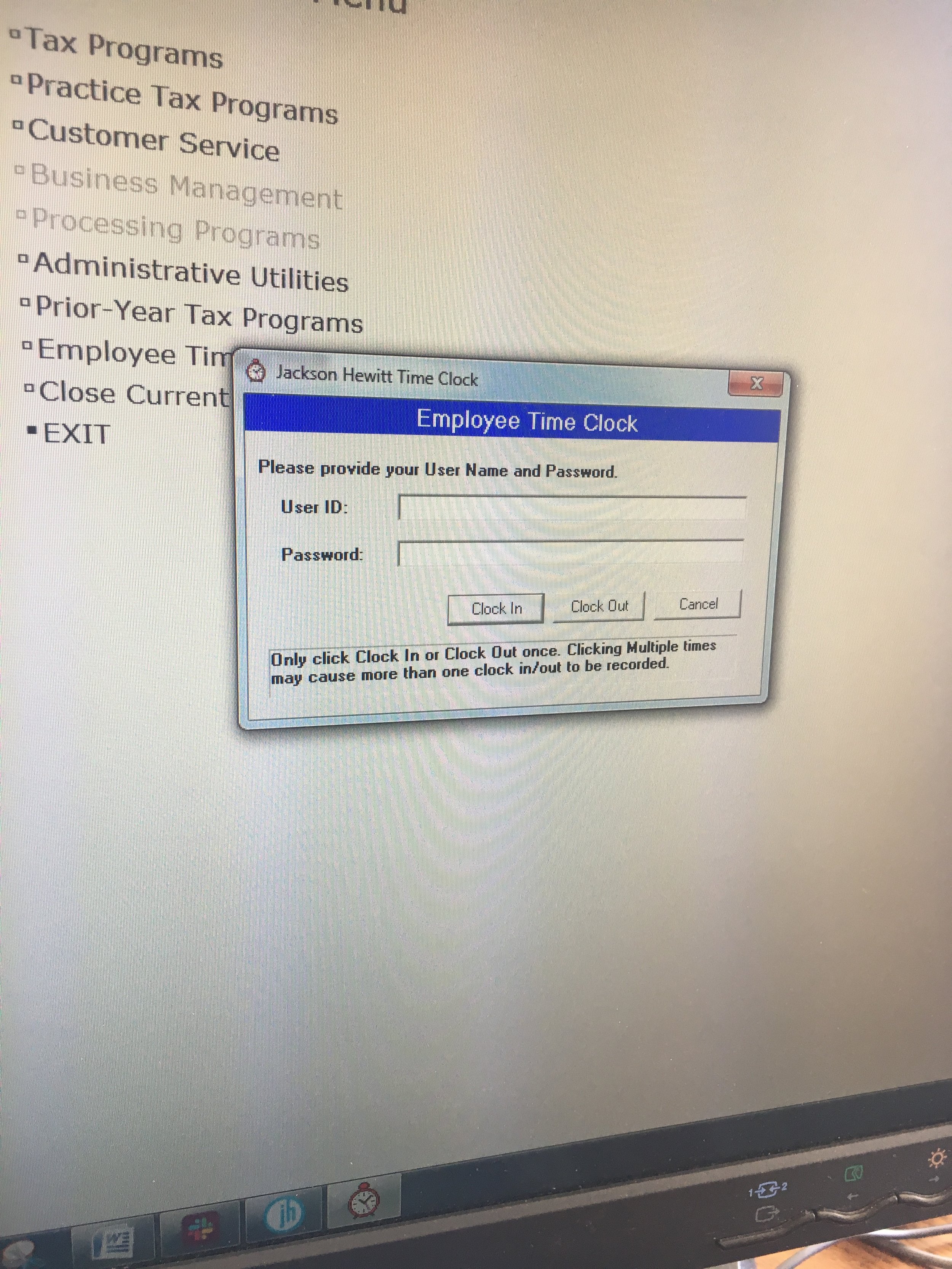

As the clock approaches the 5-minutes until open time, we get clocked in and Russ heads to flip on the neon “open” sign. Bring it on folks - we are ready to tackle your taxes.

Somedays, clients are waiting first thing in the morning, other days it seems they all wait until late in the day making it hard to leave at the day’s end. If clients are not ready and waiting, we move on to some other daily tasks. We check to make sure returns have been accepted and cross our fingers to make sure that same report doesn’t turn up any that were rejected. We high-five with the accepts and put on your problem-solving caps with the rejects. Sometimes the reject can easily be solved by correcting a typo, but more often than not the IRS-reject is that a dependent has already been claimed on another return. Then it becomes our job to notify the client and assess their options - removing the dependent from their return (which usually has a financial impact) or fighting to claim the dependent with the IRS (which slows their refund).

Each morning we “check for checks,” meaning we look for funding files that have been sent with refunds for our clients. Yes we print checks, no we cannot print checks without said funding files. That takes all the fun out of it! We do like to see that there are checks ready to be printed as that means we get to call our clients letting them know their refund is ready. You can pretty much guarantee a happy customer on the other side of the line when you tell them you have money ready for pickup! Although this is a small percentage of how clients get their refund (only about 5% choose this disbursement method), most opt for the pre-paid card offered by Jackson Hewitt and many others opt for direct deposit into their bank account, it is the most rewarding in that we personally get to hand the client their tax refund fresh off the press.

By this time in the day, likely a customer has arrived in the office in which we greet them with a friendly smile and a cheerful “Welcome to Jackson Hewitt. How may we help you today?” Aptly their response is typically a “I would like to get my taxes done today!” We then escort the client to our desk and start what we call the tax interview which is more of an information-gathering conversation than a interrogation. If it is a new client, there’s a lot of ground to cover as with a returning client, we just need to chat about big changes they have encountered during the tax year.

When they take a seat at our desk, we gather their tax documents and help them organize the paperwork we need and the paperwork they need to hold onto if the IRS would have any additional questions. In addition to the basics — names, birthdates, occupations, social security numbers, W-2s, 1099s — we use this time to figure out the most advantageous filing status and which credits may benefit the client.

While inputting the information into the software, we usually ask additional questions, but also try to entertain the client a bit. Taxes can be stressful or overwhelming to clients, so a little comic relief is a nice addition to the situation. As we progress toward the end of the interview, we reach one of our favorite parts of the process — explaining the return, refund or tax liability, and educating the client a bit. Terms like deductions, exemptions, carryovers, withholdings mixed with abbreviations like MAGI, EITC, AOTC, NOL and TJCA can make a client’s eyes glass over. So, we put on our teacher’s hat, and take some time to explain their return as well as the tax reform changes that may have impacted their return this year - some good, some bad. We finish off the return by answering questions, offering some tax tips or recommending adjustments on their W-4s. In the end, we hope we provide our clients with some peace-of-mind that their tax return was completed accurately.

If clients are waiting, the next task is to repeat the exact same process, providing yet another great customer service experience for the next customer. If the waiting area is empty, you will find us answering phones, likely answering the “Where’s My Refund?” question for the tenth time of the day. We do what we can to track the funds, but most of that is in the hands of the IRS. However, it sometimes is on our end and we work to contact our banking partners to make certain clients get their money which often includes long waits on hold and multiple follow up calls. But worth it to be able to follow up with good news for that customer.

In between clients and phone calls, we might catch up on corporate announcements, complete an online learning module or spend some time organizing in the file room.

Some days get tricky based on client volume, but a lunch break gets incorporated into each work day. Salad hour often becomes salad half-hour, but our tradition continues as a packed-lunch version.

Spending anywhere between 30 - 60 minutes with a client, we have found we quickly develop a personal connection. So when we push the submit button at the end of the interview, that isn’t the end of the customer service experience. We find ourselves watching the progress of the return to make sure it gets successfully accepted by the IRS and more importantly funded if the client is due a refund. It is a happy day, when two green dots flank the IRS and New Mexico returns and the client has received their refund.

For those of you reading this, that are going to owe the IRS, don’t worry we have some of those too, but not many this time in the tax season. We likely will see those customers closer to April 15th than to today! We will be ready and waiting to assist you in that process and make sure you get every credit and deduction you are eligible to receive.

The day usually finishes out with several more completed returns, many more phone calls some which have questions that we can answer and others that get transferred to a specific office. Somedays may include calling into a franchise-wide preparer call or running to a nearby Walmart to fill-in for an absent employee or helping out with a technology issue.

Usually the end of the day looks quite a bit like the beginning, but in reverse order. Checking the appointment schedule for the next day, logging out of all the handy resources we signed in to in the morning, straightening up the office, taking out trash, clicking the open sign to off, clocking out and locking up.

So that’s it in a nutshell - a day in the life of a Jackson Hewitt Tax Preparer. We have enjoyed the experience — from learning something new to assisting customers all while getting to enjoy the Albuquerque, New Mexico area. We may sneak in one more Workamping update at the end of the month before our final update coming shortly after Tax Day - April 15th except for our Maine and Massachusetts readers who get a few extra days to file this year!

If you are curious about the world of Workamping, checkout Workamper® News the company that coined the term Workamper® back in 1987. They offer a free membership that allows you to search for jobs and receive the digital version of their magazine. If you do opt for the gold membership which includes additional features like a resume builder & printed magaizine, we would love if you would mention that you were referred by Russ & Betsy simply by using the code AMB103.

RUSS & BETSY'S WORKAMPING REVIEWS / UPDATES:

- - - Jackson Hewitt in Albuquerque, NM (December 2018 - Current):

MONTH TWO

- - - Texas Lakeside RV Resort in Port Lavaca, Texas (November 2017 - November 2018):

- - - Acadia Bike & Coastal Kayaking in Bar Harbor, Maine (June - October 2017):

- - - Amazon Camperforce in Campbellsville, Kentucky (October - December 2016):